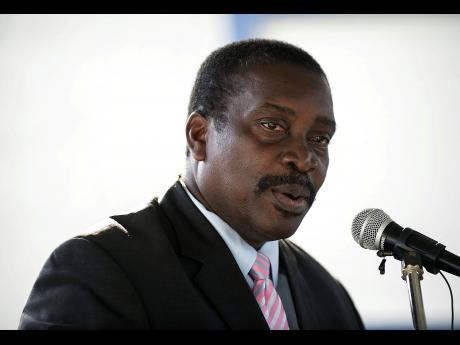

Transport & Mining Minister Robert Montague says the Government, through the Airports Authority of Jamaica, wants to woo a private investor into starting a new domestic airline.

“In today’s Jamaica, we need scheduled internal flights, so the call is for persons in the private sector to come forward and let the negotiations begin,” said Montague in an address to Parliament on Wednesday.

The carrier would effectively compete against Jamaica-based International Airlink Express, whose fleet includes a 17-seater Cessna Grand Caravan and Bahamian carrier InterCaribbean Airlines which has offered flights from Kingston to Montego Bay since 2014, and whose fleet includes a 30-seat Embraer aircraft. There are also small aircraft owners that operate charter trips between both cities.

Historically, most airlines offering domestic flights have cited major challenges of fuel, devaluation and wages. But the improved road network poses a new challenge, as commuters may opt to drive or use the bus service operated by Knutsford Express.

Still, the boss of the bus company believes the idea for a new carrier has merit.

“The cost of operations will be a factor. It will be a high price for a small market,” said Knutsford Express CEO Oliver Townsend in response to Financial Gleaner queries. It costs roughly US$60 ($7,500) each way to fly 40 minutes between cities. A one-way trip for a four-hour journey on Knutsford Express is around $3,000.

“A deep-pocket, private-sector company can give it a shot,” added Townsend, even while acknowledging that there is a lack of information on market demand.

A number of internal airlines have come and gone over the decades, with the most recent being Jamaica Air Shuttle. That airline, which operated two 12-seater Beech 99 aircraft, started service in 2009 and suspended operations in 2013. Other airlines in the past included Trans Jamaica and Air Jamaica Express.

There are also barriers to market entry from a regulatory and financial perspective. The largest start-up costs pertain to the acquisition or leasing of turboprop planes. One of the most popular aircrafts, a Beechcraft 35-seater, can cost US$500,000. These costs result in airlines operating with a thin break-even margin which, optimally, requires near-to-full seats on each flight.